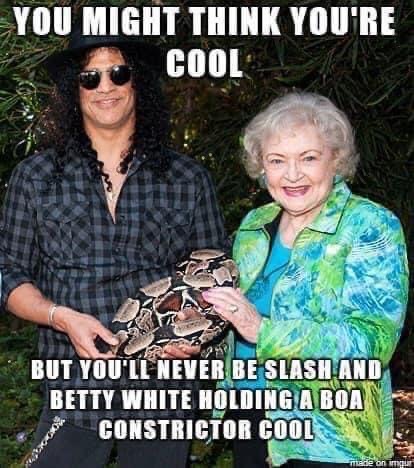

Thank you to Slash and Betty White for reminding us to be cool and play the long game!

By now everyone has seen last week’s earnings highlights. The one that really caught my attention read “Goldman Pays Up for Talent, Sending Profits Down”. Huh? In 2021, Goldman reported record net earnings of $21.6 billion, more than double 2020 results of $9.5 billion, and more than double results in recent history, $8.5 billion in 2019, and $10.5 billion in 2018.

JP Morgan was hit with a similar headline, “Wells Fargo Up, JP Morgan Down”. This on 2021 net earnings of $48.3 billion, which soared 66% to 2020 results.

These onerous headlines were referring to quarterly changes. Goldman Q4 net earnings of $3.9 billion fell (27%) to Q3, and (13%) year over year. JP Morgan Q4 results of $10.4 billion fell (11%) to Q3 and (14%) year over year. This is important because long term capital appreciation demands a long term growth strategy. The problem is short-termism. CEO’s are under enormous pressure to deliver strong quarterly earnings reports and to distribute wealth rather than reinvest. Investors responded this time by sending shares of Goldman and JP Morgan down.

In a 2015 article I wrote, McKinsey’s Dominic Barton, BlackRock’s Laurence Fink, and Rodel CEO Bill Budinger intensified the debate on the short term approach, challenging leaders to play the long game.

I think Jamie Dimon got it right in his response to investors, “We will be competitive in pay. If that squeezes margins a little bit for shareholders, so be it.” Further, Mr. Dimon asserted that JP Morgan wouldn’t meet its longer-term target returns this year and maybe next year. I’d say that qualifies as playing the long game, as Laurence Fink’s 2015 letter to Fortune 500 CEOs urged.

While Wells Fargo is cutting costs, other banks with bigger Wall Street operations reported higher expenses, largely because investment banking and trading results have soared, with the demand for talent high. It has taken more than ten years for global markets volume to rebound since the near collapse of the world financial system in 2008 and 2009. This is welcome news not only for an industry forever changed by these events, but for New York City and State tax coffers. This will also help small business in the New York metro area, COVID notwithstanding, in a city metropolis plagued by increasing income disparity.

What else are the big banks investing in? The answer is technology. Advances in artificial intelligence (AI) and machine learning (ML) factor squarely in post trade settlement. Ongoing transformation in cloud operations, interconnection, communication services, payments, and enhanced data security are also garnering noteworthy investment.

Technology spend worldwide is projected to grow 5.5% in 2022 to $4.5 trillion. This follows a robust level of investment in 2021. As one example, investments in European tech firms soared to $93.3 billion last year, a record, and a 142% increase over the year before, according to CB Insights.

U.S. Banks are very focused on this. JP Morgan has instituted a technology in residence program and recruited McKinsey Partner Neha Gargi as their new Head of Global Technology Strategy.

Goldman is leaning forward as well with deep talent search. In Spring 2021, they reached out to me, having identified my trading technology FP&A background. I interviewed with a veteran new hire leading their technology efforts in their Americas Operations group. This person had an engineering and product background outside capital markets, most recently within the APAC region. I didn’t land the role but it really caught my attention, revealing the intensity of their strategic focus.

Where is this all leading? Utilizing the long game, I’m bullish on America and believe we can transform the U.S. economy and regain the top spot from China. But we need to get going on this.

In some related good news, mountains have moved on Capitol Hill with groundbreaking bipartisan support in the U.S. Senate, with passage of the $250 billion U.S. Innovation and Competition Act, also known as the Endless Frontier Act. This week the U.S. House takes up this effort, largely seen as a critical and effective means to counter China’s technological ambitions.

So let’s get moving! What are your thoughts on this? I’d love to hear!

As always I’m reminded that nothing lasts forever, even cold November rain. Hmm, sounds like song lyrics. Enjoy!

Feature Photo courtesy of the IMGUR platform and the L.A. Zoo, on whose Board Slash sits, along with Betty White when she was still with us.

Please note Addendum links below to supporting articles.

Goldman Sachs Sees Profits Slips

Wells Fargo Up, JP Morgan Down

Cynthia 2015 Article Long Term Capital Appreciation

Banks like JP Morgan: Inflation Is A Double Edged Sword

Gartner projecting $4.5 trillion Tech Spend

JP Morgan Technology In Residence

JP Morgan hires new Head of Global Technology Strategy

Bipartisan Senate Passes Bill To Boost China Competitiveness