In the United States, 2021 U.S. record industry sales revenue totaled $15 billion2 on 418 million units sold, at a total average unit price of $25.873. In comparison to 2020, sales revenue grew 23%, a new annual growth record. The average unit price increased 25% on robust growth in digital streaming subscriptions and the first annual increase (+56%) in physical sales since 1999. Wow! Further, since 2015, the average physical unit price has risen from $14.04 to $18.72. The volume is still a far cry from the height of the market, but it’s very encouraging to see positive growth!

Ironically, the digital music format that sent the global recorded music industry plummeting by more than half between 1999 and 2014, is now leading the revival. 84 million U.S. consumers paid for interactive digital streaming subscriptions in 2021, more than double the 35 million who paid in 2017, and nearly 14 times higher than the 6 million who did so in 2013. Associated revenues hit $8.6 billion in 2021, while also maintaining an annual average paid subscription rate just above $100 since 2013. To see annual streaming growth rates in the U.S. of 20-60% without price erosion is most encouraging.

Streaming growth is expected to continue with projected 2030 revenues to reach $38 billion globally, but at a slower annual rate of 10-15% as the market matures, according to Goldman Sachs Analyst Lisa Yang’s team. Of the forecasted $38 billion, expect $27 billion in paid subscription and $11 billion in ad supported. Also to note, China, whose streaming service Tencent reports 71 million paying subscribers and 636 active monthly users, is forecasted to surpass the United States in streaming revenues before 2030. Goldman 2020 Music In The Air Report

This leads us into the important discussion of “On Demand Ad Supported Streaming”, which is primarily YouTube, and new entrant TikTok . In 2020, Lisa Yang reports that the average royalty rate per video stream was 3x lower than the rate per audio stream in the U.S. I should note that the gap is about 6x lower when comparing pure on demand add supported video. Said another way, the YouTube “Value Gap” is still significant. While some see evidence of an improved relationship between music content owners and YouTube, I can tell you first hand, we have a long way to go. Currently, there are about 1.9 billion active monthly users on YouTube versus 406 million Spotify, 80 million Apple, and 60 million Pandora. To be clear, this monetization gap is not sustainable for the music creative community. The entry of TikTok and future renegotiations with the record labels might just provide some leverage, given the success of this new platform. I’ll stay on this.

The final and most important point we need to discuss is songwriter compensation. There is a major disparity in today’s digital streaming era, between royalties paid to the recording artist and record label for the sound recording copyright, versus the royalty paid to the songwriter and music publisher for the “song” copyright.

For every $10 monthly streaming music subscription, here’s where it goes:

Platform $3.30

Record Label $3.80

Recording Artist $1.70

Music Publisher $0.60

Songwriter $0.60

While the recording artist is able to negotiate in an open market, the songwriter’s royalty is regulated by the U.S. Copyright Act of 1976, and more recently by the passage of the groundbreaking Music Modernization Act (MMA) in 2018. While the passage of the MMA resulted in the U.S. Copyright Rate Board (CRB) declaring a much needed royalty increase to songwriters for the 2018-2022 term, the powerful digital service providers (DSPs), led by Spotify, appealed this rate increase in a most disingenuous fashion! To date, the matter has not yet been settled in the courts. Moreover, the DSPs are requesting a further rate reduction for the 2023-2027 pricing term. This is not a sustainable model for the songwriter! Just remember, without the songwriter there is no song, and without the song there is no music!

Please ask me about a leaning forward, badass organization doing something about this, Songwriters of North America (SONA). Look for future updates in 2022 as I stay on all of this!

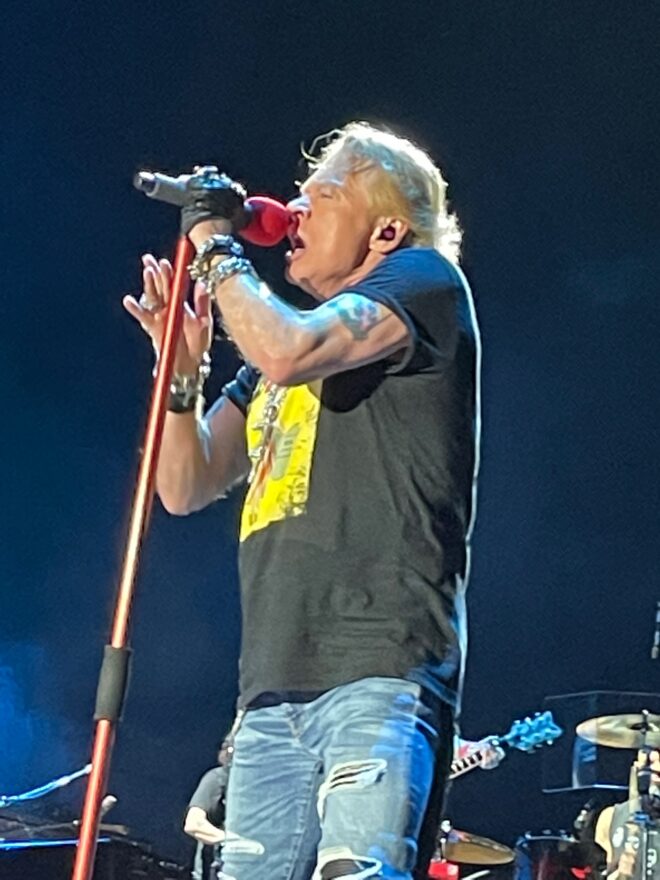

I guess it’s only fitting to take you out with some live photos from the rail for Guns N’ Roses August 2021 LA Stadium performance. Enjoy!

1 All Global data is sourced by the IFPI 2022 Global Music Report Summary IFPI 2022 Global Music Report Summary

2 All U.S. data is sourced by the Recording Industry Association of America database, with all $ figures not adjusted for inflation. U.S. RIAA 2021 Year End Music Report

3 2021 U.S. total units sold of 418 million includes 84 million paid subscription streaming. Please note that certain forms of revenue cannot be quantified in units sold and are therefore excluded in the average price calculations. This includes Limited Tier Paid Subscription, On-Demand Streaming (Ad-Supported), Sound Exchange Distributions, Other Ad-Supported Streaming, and Synchronization revenue.

Love your work and passion!

This is a fascinating read!

Thank you for sharing.