The Rolling Stones are the GREATEST Rock&Roll band on planet earth. Full Stop. 80 year old Mick Jagger and Keith Richards, 76 year old Ronnie Wood, and their magnificent touring ensemble brought down the house at MetLife Stadium Thursday night May 23, 2024 in perhaps their final tour performance of an enduring 60+ year career! Aptly named Hackney Diamonds for their latest album release as octogenarians, the Rolling Stones delivered a heart thumping two hour 19 song set to a completely enthralled New York tri-state audience!

They stormed on to the stage with Start Me Up, a classic opener through the years, because why fool with success! The audience was ALL IN by the second song of the set, the hard charging Get Off My Cloud! Paying homage to the NYC Boro of Manhattan, they followed with a rare tour set of Shattered that electrified the audience!

They introduced two new hits from Hackney Diamonds early in the set, Angry and Mess It Up. There was no looking back after that. This quintessential and incredibly talented band of bad boy Rockers engaged this adoring crowd in exquisite order, performing their hearts out to generations of longing fans.

The Rolling Stones first performed live in the United States the year I was born, on stage at Carnegie Hall in June 1964 when I was just two months old. It would be seventeen years later for The Tattoo You Tour, in a wild road trip to the Carrier Dome at Syracuse University on November 27, 1981, that I had my first opportunity to sway and fro live to these bad boy Brits I adored beyond measure! Many of the classics we heard that fateful night long ago, were featured here tonight at MetLife Stadium. Pure magic. Memories of a lifetime.

My very first time in the pit for this classic Rock&Roll band I’ve seen live many times, I was moved to tears for fan voted Wild Horses, classic anthem You Can’t Always Get What You Want, and the apocalyptic Gimme Shelter. It’s emotional still to write this bit.

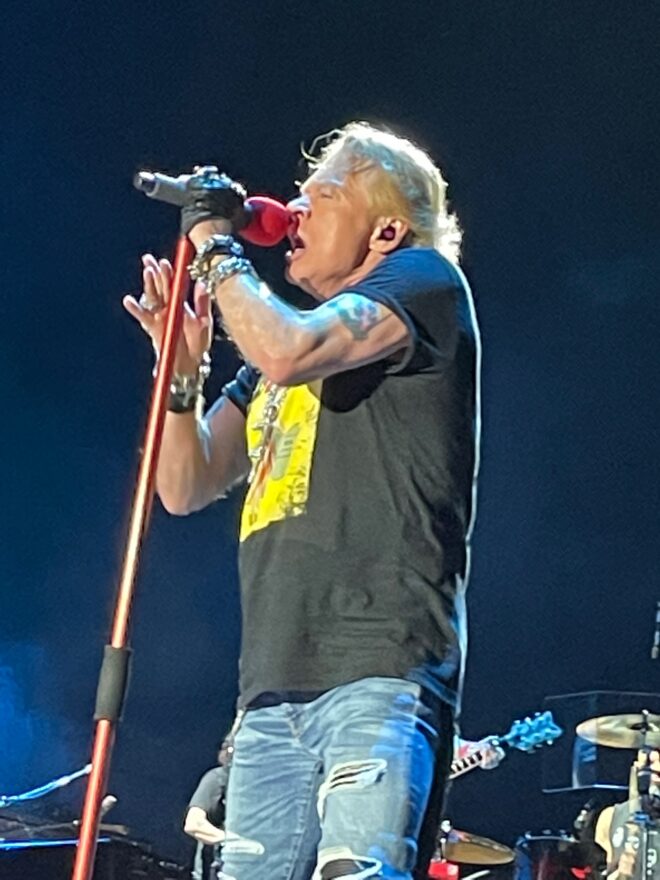

With masterful vocal ability STILL, Mick Jagger has perfected his vocal craft training unlike few others. It’s only Rock&Roll, but I like it, like it, yes I do! Of course, the physical training regimen is equally impressive. As a reminder, Jagger underwent minimally invasive heart valve replacement surgery in April 2019 at a New York hospital. Highly disciplined and very pragmatic, Mick starts physical training six weeks before tour rehearsals even begin. “The heart is not meant for high energy rocking when you’re in your 70s and 80s.” Oh okay. So that’s how he sprinted a 50 yard dash down the catwalk and gracefully slid down to a side pose on the ground, then promptly jumped back up, like perhaps gymnastics phenom Simone Biles. That’s how you close out a hard charging Rock&Roll set after 11pm, when you’re a GOD DAMN ROCKSTAR! Jumpin’ Jack Flash baby!

Lead guitarist, vocalist, songwriter Keith Richards was just brilliant and lovely, perhaps feeling something extra special playing for his hometown crowd, as a Weston, Connecticut resident. Keeping it cool in the pocket, he ventured out on to the catwalk for a few perennial favorites, and expressed sincere gratitude to all his fans with a smile that just made your heart melt. He really commanded our attention with a strong vocal performance in You Got The Silver. Quite coy and with delicious humor, he confessed to “not having any idea what this song is about, and I wrote it” as he launched into a sweet performance of Tattoo You fan favorite Little T&A. Memories of a lifetime.

Energetic Ronnie Wood was all over the stage, jamming away, clearly electrified by the fans! It was just magic watching him and Keith align in creative choreography on the electric guitar. Add Jagger to the mix, who’s clearly in charge, we bore witness to these three veteran friends and worldly musicians meet in the pocket to sync and create musical masterpiece! Pure heaven and shall I say it again, memories of a lifetime!

Bringing it back to the ROCKSTAR that is Mick Jagger, recognizing the power of his célèbres, he of course encouraged us all to vote. Speaking to the power of music to heal, he referenced the trials and tribulations New Yorkers have been going through, and expressed gratitude that the mighty thunder showers that blew through earlier in the day had cleared out, saving us from enduring a Stormy Daniels. HA! I love you Mick to the moon and beyond.

Of course we have to highlight the wildly talented ensemble touring band, that reveals the dedicated creative brilliance of this London School of Economics student who left college, much to his father’s chagrin, when the Stones landed their first recording contract in 1963.

Keyboardist Chuck Leavell, who has been with the Stones since 1982, delivered some exquisite funky piano solos. Bass player Daryl Jones, who has been with the Stones since Bill Wyman’s 1993 exit was just outstanding. His solo on Miss You, with Mick stomping in front of him, was pure milk and honey! Back up Vocalist Bernard Fowler, next to the incomparable Chanel Haynes who I’ll speak to in a minute, did not disappoint! Well respected and known quantity to the band, Drummer Steve Jordan was recruited to replace the beloved Charlie Watts who passed away in August 2021.

An awesome funky Brass section completed the ensemble with Matt Clifford on the French Horn, delivering poetic sweetness in the classic You Can’t Always Get What You Want. Long a fan of the saxophone, the Rolling Stones brought in two players, Karl Denson and Tim Ries.

Chanel Haynes. Full Stop. A 45 year old New Orleans native and two time Grammy nominee, first discovered by Quincy Jones when she was a teenager, delivered a stunning and magnetic performance Thursday night! Her first platinum album as a young lead singer of gospel trio Trinitee 5:7, they spent nearly two decades entertaining audiences around the world including Madison Square Garden and Wembley Stadium. A new mom at 39, she gave birth to her first child in 2018, the same year she won the B. Iden Payne Award for Best Leading Actress in a Musical, for her portrayal of Billie Holiday in Lady Day at Emerson’s Bar and Grill! Cast in the lead role in The Tina Turner Musical in 2021, the masterfully brilliant Mick Jagger recruited her to the tour ensemble backup singer section in 2022, but clearly for the feature female performance in the classic Gimme Shelter! As a very important touring member of this iconic Rock&Roll band, with incredibly powerful and nuanced vocal ability, and with a commanding presence on stage, the sultry Chanel Haynes strutted about with an incredibly fit and agile Mick Jagger in a duet that brought an already exuberant crowd to levels of ecstasy that defy words. Jagger brought her back out for the first of a two song encore for new Hackney Diamonds hit Sweet Sounds of Heaven before launching into the perennial closer I Can’t Get No Satisfaction. Masterful set list that brought us all to our knees!

Opening act Jon Batiste was equally phenomenal! Masterful pounding piano and mighty vocals on full display stomping across the stage and the Stones’ long catwalk. My first tears of the night came during a mix that included Leonard Cohen’s Hallelujah as only Jon Batiste could perform. A commanding performance, surrounded by huge brass and ensemble talent, that earned a heartfelt shout out by Jagger during the main set, the crowd at Met Life Stadium ate it up with thunderous applause!

If you have an opportunity, GO SEE THE ROLLING STONES. Bring your kids. There was a couple in the pit next to me, inches from the rail, that brought their 7 year old son. A lifelong fan with perhaps a British accent, the dad was firm, “I need my son to see the Rolling Stones live.” They had a brilliantly designed step stool disc that met the entry requirements and unfolded in effortless fashion. Of course they did, they’re Rolling Stones’ fans.

I’ll take you out with this one. Enjoy!

Met Life Stadium May 23, 2024 (I Can’t Get No) Satisfaction

Setlist

1. Start Me Up

2. Get Off of My Cloud

3. Shattered (tour debut)

4. Angry

5. It’s Only Rock ‘n’ Roll (but I Like It)

6. Wild Horses (fan-voted song)

7. Mess it Up

8. Tumbling Dice

9. You Can’t Always Get What You Want

10. You Got the Silver (Keith Richards on lead vocals)

11. Little T&A (Keith Richards on lead vocals)

12. Sympathy for the Devil

13. Honky Tonk Women

14. Miss You

15. Gimme Shelter

16. Paint It Black

17. Jumpin’ Jack Flash

Encore

18. Sweet Sounds of Heaven

19. (I Can’t Get No) Satisfaction